Over 40% of mortgages in Australia are sold by mortgage brokers, not by their manufacturers – an issue that has the CEO of Australia’s fifth largest bank, Suncorp, arguing the sector is skewed towards the big four banks.

There are two distinct components of the mortgage market: a retail market with a wide variety of sellers, and a wholesale market.

The four big manufacturers of mortgages in Australia are the big four banks. One of the key issues for the Murray inquiry into the financial system will relate to competition, or the lack thereof, in the manufacturing of mortgages. Does it matter that some 90% of mortgages are manufactured by four producers?

There are a number of ways of answering this.

Oligopolies reign…

The first is that there are many industries in Australia with fewer than four major manufacturers of goods and services. Telephone services, domestic airlines, energy supplies, postal services, cars, steel etc. all come quickly to mind. In fact, most Australian industries are characterised by a small number of manufacturers. Any industry with economies of scale, like banking, seems likely to be relatively concentrated given the size of the local market.

The second is to ask whether the concentration is temporary or entrenched.

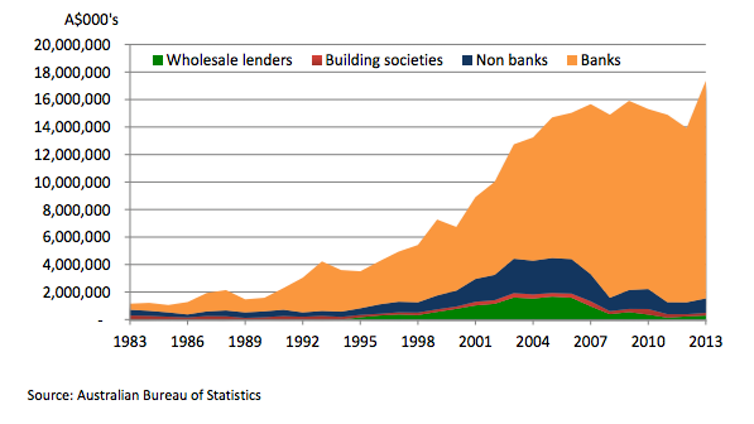

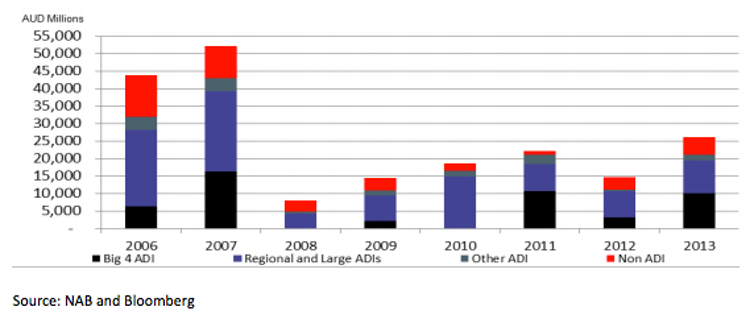

There were a lot more manufacturers of mortgages before the financial crisis. Most of them were funded not from deposits but by securitising their mortgages and obtaining funding from the wholesale markets. During the crisis, this market contracted sharply, mainly because of problems in the US market for securitised products, which made the business model unviable. The government stepped in under Treasurer Swan and subsidised securitisation by the smaller banks during the crisis to enable them to stay in the business. This was a subsidy from taxpayers directed exclusively towards the smaller banks.

As the securitisation market returns, as it should because there were no problems with the market in Australia, then this will return to be a secure funding source for the smaller banks. The rebuilding of market sentiment will allow the smaller banks to re-enter the market as manufacturers of mortgages.

Macquarie Bank, too, has shown a willingness to depart from the mortgage market when times are difficult but to re-enter aggressively as it has recently. Again this is another indicator that the market concentration is high but the market remains contestable.

Price competition

The third broad concern is whether there is price competition for mortgages at the wholesale level. At the broadest level the Reserve Bank has concluded:

the available evidence suggests that the average spread to the policy rate on variable-rate mortgages in Australia is within the range of those in other advanced economies – RBA submission to the Murray inquiry.

So the overall level of mortgage margins does not appear to be out of line with prices in other countries.

The remaining issue is whether there is price competition between the four manufacturers and whether market share changes when price changes. The normal test used in industrial economics is to ask whether an incumbent would lose significant market share if it raised prices by 10% above the level of its competitors.

With mortgage rates currently around 6%, the question is whether a bank would lose significant market share if it offered a standard variable rate of 6.6%, while the other manufacturers had prices around 6%. There really seems little doubt that the high price would cost an incumbent significant market share, suggesting that no provider really has market power in mortgages. Just by cutting its mortgage list price by 0.10 to 0.15 of 1%, NAB increased its market share significantly during its break-up marketing campaign.

Since the financial crisis, the big four banks have become the principal manufacturers of mortgages in Australia. They market some mortgages directly, some through second-tier brands, and some through brokers. Their leading position in manufacturing since the crisis is mainly the result of the wind back of second-tier banks which were funded through securitisation in the wholesale market, and partly because of the changed status of St George and Bankwest when they were taken over by majors.

Such a high level of concentration is not unusual for an Australian industry. Nor is it clear that prices are out of line. The situation is also likely to prove temporary as re-emergence of the securitisation market will enable alternative manufacturers to fund their lending, and new vigorous competitors like Macquarie have already re-entered the market.