Self-employed people don’t like refinancing their loans, particularly those with business liabilities, trusts and complicated structures. Until now, the banks have insisted that everyone provide a bunch of tax returns and stuff.

If you forward this email to someone who’s self-employed, you might set them free! …they might just be your best friend for life.

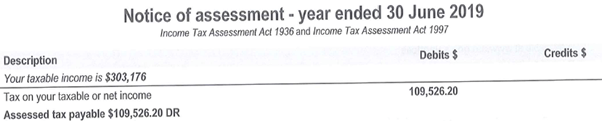

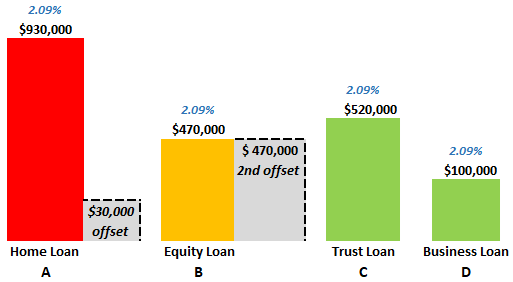

We now have the power to ask ONLY for two pieces of paper, being your last 2 Notices of Assessment!

Just like the 2 that Dr Greg gave me last week, which I have pasted below:

Yes, I have triple-checked that the TFN’s aren’t showing! (…and Greg isn’t her real name)

…no tax returns, no financial statements, no trading statements, no evidence of rental income… just what you ended up paying tax on in your individual names.

You can either give us your NOA’s for ’2019 and ’2020 OR ’2020 and ’2021

For Dr Greg, we don’t need to worry about his company credit card limits, vehicle commitments, his $100,000 unsecured Medfin loan or even the bits of Jobkeeper & Government Boost subsidy income that since the pandemic started, I’d otherwise need to subtract from Net Profit.

OK, I think you get it now.

Dr Greg had a $1,400,000 home loan with $500,000 in his offset account.

The amount he gets charged interest on is therefore $900,000 (what we here at iChoice refer to as the ‘effective debt’).

$1,400,000 less offset $500,000 = $900,000 effective debt.

Dr Greg politely told me 5 things;

He was open to refinancing his home loan, but insisted on a Big 4 Bank

He plans on taking the family to Bali soon, which might cost $30,000

Prior to restructuring our clients’ lending, we always ask what may be on the horizon

He needs $520,000 to buy an interstate property soon for $500,000

Always borrow the full 104% of costs for any property purchase that will, or may become, deductible

This property has been exchanged in the name of a newly established Unit Trust for Asset Protection (he’s actually really annoyed that back in the day he purchased his family home in his name, rather than in his wife’s name).

Bankers refer to sole-purpose Unit Trusts as SPV’s, meaning ‘Special Purpose Vehicles’. Just another bit of jargon to make us bankers (and ex-bankers) feel special, I guess ~

He wouldn’t mind stretching out his unsecured Medfin loan for a longer-term, at least until he owned his home outright. Thank you, Dr Greg! He fully gets that good debt should NOT be repaid quickly.

We explained that having all his savings of $500,000 in an offset account against the home loan might not be best – this needed revisiting.

We squashed his home loan limit down to what it needs to be, leaving the equity that he wants to retain for the future, separately identified as Loan B, as big as it can be, which will be full in offset.

It makes little difference now, but might be very helpful down the track, depending on what he ends up using the unlocked equity for. It costs no more to have your lending structured perfectly, and your accountant will buy you a beer for it.

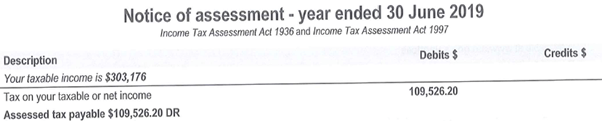

We electronically lodged his application yesterday, structured as follows:

Remember, given his income comes from a variety of trusts and companies where he is a part shareholder, and his various company commitments, he would not have got this result anywhere else, certainly not with his NAB Health business banker.

Sorry to the NAB Specialist Bankers out there, I was you only 14 years ago! No offence guys 🙂

Loan A reflects his effective debt relating to his home and no more, other than the $30,000 in his transactional offset, earmarked for when he soon takes his family to Bali.

It’s coloured red, as the interest on this loan is not tax-deductible. This is the loan he needs to concentrate on paying down first and fast.

Loan B reflects the unlocked equity; it’s all in the Equity offset account, so no interest is payable on this loan. It’s essentially a Line of Credit, just upside down, and cheaper.

It’s coloured amber, as the tax deductibility will be subject to what purpose he actually uses the funds for on this newly established facility.

Loan C unlocks $520,000 for him to on-lend to his Unit Trust for the forthcoming property settlement.

It’s coloured green, yes it’s tax-deductible. This loan will sit in the Balance Sheet of his Unit Trust as a shareholder’s loan; the interest will be claimed in the Trusts’ P&L.

Loan D unlocks $100,000 for him to pay out his business loan, thus stretching this deductible debt out for a fresh 30 years. Awesome; of course, he should be committing all of his extra repayments into Loan A. Yes, Loan D is green, you get it ~

Asset Protection

Dr Greg is adopting two strategies to strengthen his family’s Asset Protection.

All his loans are to now be secured by his home (remember, it’s in his name, a sitting duck), soaking up a chunk of the equity. Good.

The investment property has been purchased in a fairly secure Unit Trust, actually a bit more than ‘fairly’ because even though he is the shareholder of the Trustee company and owns all the units, guess who he has put as the Appointor and the director of the Coporate Trustee ???

This is as juicy as it gets. Next-Level! But since I’m a bit embarrassed that I don’t have many followers on Facebook, I’ve answered this in my most recent post. Hope you don’t mind me encouraging you to jump onto either LinkedIn or Facebook to like me or whatever, to find out. The link is in my email footer or just search ‘iChoice’. Thanks in Advance guys 🙂

Personal Benefit

Dr Greg will learn next week that the free credit card we’ve arranged under the package allows for two annual free passes to the International Qantas Lounge.

As he and the fam. get ready to depart for Bali, I hope he thinks of iChoice as he has his crossiant and cappuccino 🙂

And I guess the $3,000 refinance rebate he’ll get for setting up this super-structure will pay for a few days of his holiday also, forgot about that…

Top 10 mechanic in Australia

I’m trying to think of another industry like mine…

Imagine if you could service your prized car like your lending: a specialist Top 10 Australian mechanic with 25 years’ experience could increase your cars’ efficiency, decrease fuel consumption and make it run smoother, all for free; and arrange for the dealership to offer a $3,000 cash ‘rebate’ for the bother…

Nah, I can’t think of one ~

I don’t see myself as a salesman. I just have in my office a few of the finest mortgage professionals running the show; I’m just into numbers and patterns. It’s about all I’m good at, so I’m glad.

I nevertheless just love this pic; it’s a reminder that we all don’t know what we don’t know:

For those of you locked into fixed rates, you’re doing just fine!

Even if you’re figuring out that you might not be getting the advice you deserve, you might be better off now just waiting. The fixed rate you’re on is probably not achievable in the market right now, so stick with it for a bit.

But I’d love to hear from you later in the year ~

That is, unless you have several properties. In this case we may be able to substitute some security properties around to retain your fixed rate loans where they are, and still embrace this NOA-only-policy to kick ahead, while it still exists.

Sorry again for the length of this email, my videos are just the same… honestly, I just can’t help it.

But I’m trying ~

I’m not sure if it’s a ‘problem’ but I’m naturally very empathetic. But I sunk into a hole 2 years ago when some clients of mine experienced immeasurable grief. A week later I made a decision to concentrate on worrying only about things I can control, otherwise I would have stayed unwell. My job is to be the best I can be to my family, friends, clients and everyone I deal with every day.

Naturally, I’m concerned with what’s happening in Europe and the fate of Ukranians and perhaps those in Taiwan. But for my own well-being and for those around me, I cannot let it consume me. I must abide by my self-imposed philosophy that ‘the show must go on’. I feel a bit weird writing emails whilst all these things are happening in the world, but I’m trying not to.

Hope you’re having a nice weekend,

Yours financially,

Jason