Big 4 Bank offers 1.79% for 2-year fixed, with $3k rebate

For those who fixed their interest rates in the last couple of years, you can’t feel bad about that. It’s like getting angry that you haven’t crashed your car all year, meaning the annual insurance premium was a waste! But it is now time to ask your bank what your break cost is. The AUD has hiked this week, based on expected rising inflation on the back of the faster-than-expected Australian recovery. I really don’t think today’s fixed rates will last. This is what we can get you with a 2-year Fixed rate, from a Big 4 if your borrowings are < 70% LVR and > a mill:

- Home Loan = 1.79%

- Investment Loan = 2.19%

And for those of you who want to keep your good loans high so you can concentrate on paying down your bad loan:

- Interest-Only = 2.39%

And for the bears amongst you wanting to stay variable:

- Packaged Variable = 2.39%

- Basic Variable = 2.19%

Medical professionals who have utilised the 90% no LMI-offering and have geared yourself to the max, you’ll need to add 10 basis points to the above rates, which aren’t really advertised but do exist and do reward (perceived) lower-risk borrowers.

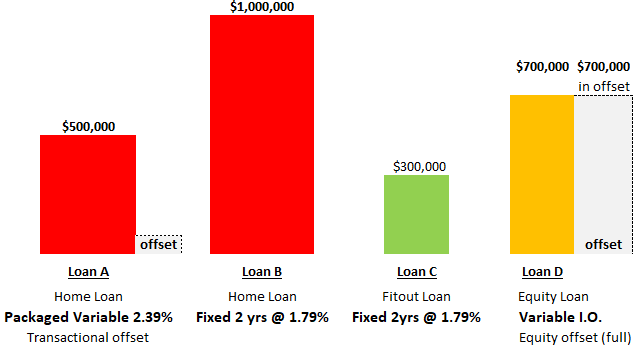

I met with Dr Bob last Sunday in his awesome home worth $7M. He has a $2.5M home loan with $700,000 in offset. So his Effective Debt seems only $1.8M. The thing is, $300K of his home loan was used to fit out his dental surgery, which he cleverly secured by his home to get a you-beaut rate and a 30-year-loan term, to stretch out good debt. But the structure is all wrong. This is how we tidied it up, with his permission, fixed for 2 years a massive chunk of his home loan at today’s ridiculous rates. We left $500K variable, with offset, so he can more quickly pay his home loan down.

Loans A & B are red, since the interest is not tax-deductible.

Loan C is green, the tax-deductible bit that relates to the fit-out has been extracted and given its own split.

Loan D is amber (sorry it looks a bit yellow). It’s the equity he had already unlocked but we importantly re-set it as its own split. It’s I.O for now, so no interest at all will be charged while he’s not using it.

Whether Loan D ends up being tax-deductible or not depends on what he eventually uses the funds for. If he buys a sailing boat? No sorry. If he decides to be his own bank and lends the money to his Self-managed Superfund to refinance the expensive SMSF loan he has, yep! Down the track, if he decides to buy an investment property, we’d normally borrow 14% against his home (which would be green) and 90% against the place itself, to avoid cross-collateralising. But these days an option would be to borrow 34% against the home, and 70% against the place itself, to take advantage of risk-based pricing.

What’s also apparent is that if Bob wants to buy something for $650K, he doesn’t even need any more loans! He could just rip out the funds from his Equity Offset account resting against Loan D and buy it in cash. Any agent or vendor wants Bob to go to the auction and win.

If you’re up for big break fees at your bank you can just ask them for an estimate of what it will be, let me know your fixed rate and the expiry date, and it will take me (my 4 staff) 2 minutes on Excel to let you know if it’s worth breaking or not.

You do this by calling your bank and say, ‘if I wanted to make all my loans variable, what will the break costs be please?” It’s that easy. If you can’t win, you change the rules, right? Don’t you watch Suits?

If you have time this weekend, you could print the 1-page form here (sorry I’m 50 years young and so not very tech-savvy).

I’ll then be able to do free modelled estimate valuations to see if you’re at 70%, or 80% or 90% and be able to best advise in relation to rates and structure.

Don’t even write on your mobile if you want, we can do it all via email if you prefer.

My services are free, rates are crazy low and while the banks are paying thousands in (unlimited) refinance rebates (per property), maybe now is your time.