A Super plan

for a Super future.

Self-Managed Super Funds – SMSF Loans – SMSF Investment Strategy

We’ll simplify the confusion and determine if an Self-Managed Super Fund strategy is right for you.

FIND THE COMMERCIAL LOAN THAT'S RIGHT FOR YOU

Too many people set up a Self-Managed Super Fund to buy a property, who shouldn’t really be doing so. At the same time, there are many it really suits who just haven’t got their head around it yet. We all need to understand that Super simply provides a safe & preferential tax environment, proudly offered by our Government to encourage us to end up not relying on the Government pension. Not for a holiday house, not for your parents to live in, but a clear investment strategy to provide cash or income for retirement. Whilst you’ll need to be advised, buying in Self-Managed Super Funds generally ticks both the tax minimisation and Asset Protection boxes. When buying residential property, at a couple of the banks, you can indeed have an offset account against the loan, which is handy to manage the cash you have in Super to cover outgoings and the like.

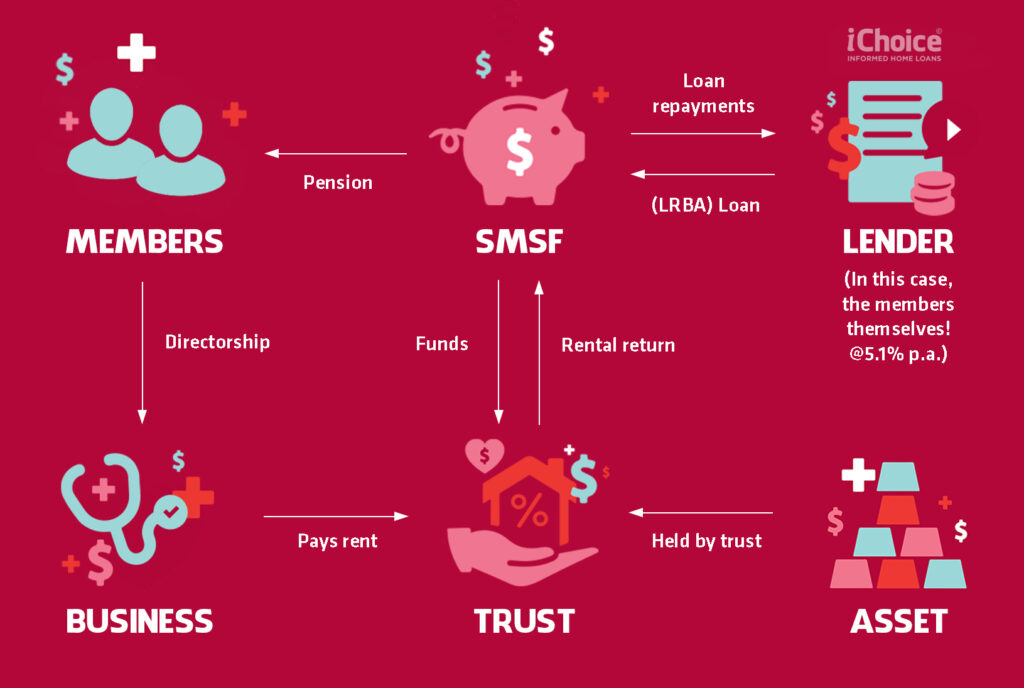

When your capacity to service loans is assessed, for lending outside Super, the bank takes into account at all your commitments and will NOT account for the income that’s forcibly put in Super (your ‘SG’ or Superannuation Guarantee).However, when it comes to SMSF’s the banks can consider only your regular contributions into Super and the rental income the acquired asset will generate.We recently helped a dentist buy her surgery building and it actually wouldn’t have worked outside super, given her numerous other financial commitments from her investment loans. Anyway, she’s much better off using the mighty Self-Managed Super Fund tax haven…

If you’re looking to move a property you already own into a Self-Managed Super Fund, you’re laughing if you own it in your personal name/s, otherwise normal stamp duty will apply. Still perhaps worth doing, especially if the strategy is to recycle some cash from your Self-Managed Super Fund (SMSF) into your hands (or your owner-occupied home loan, which you of course service with your after-tax dollars and any strategy to reduce that should be explored).

You’ll need to get the Custodian Trust set up prior to exchanging contracts. This also called a Bare Trust, meaning it can hold only 1 property in it and nothing else, which is what the bank gets to take a charge over.

The law makes it this way so the bank can’t get their hands on other assets you have in super, like shares.

You might know it as Limited Recourse.When buying residential property, at a couple of the banks, you can indeed have an offset account against the loan, which is handy to manage the cash you have in Super to cover outgoings and the like.For commercial property, the rates and terms of all banks vary a lot, so specialised advice is recommended – and we specialise in this field.

An example…

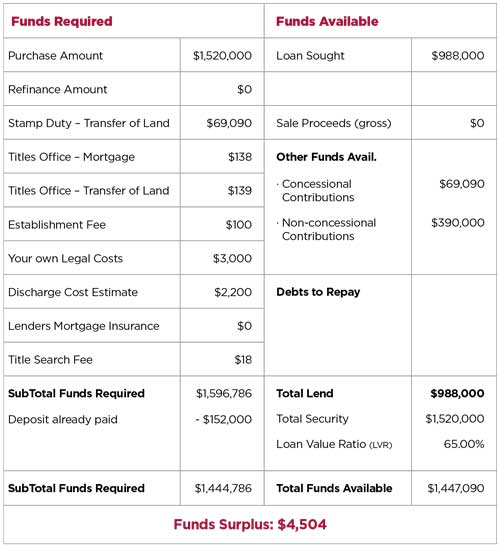

Jack is a doctor and with his wife purchased his new surgery last year in his Self-Managed Superfund (SMSF).The cheapest rate we found was offered by a bank who restricted the LVR to 65%. They didn’t the 35% plus costs in my Super, so we recommended they extend the settlement period to July 7th, enough time for them to each concessionally contribute $35K in each before June 30, and then again on July 2. The rest came from their investment offset account, which they non-concessionally contributed (meaning they got no tax break for that bit).On commercial terms, his business lent their Self-Managed Super Fund the GST of $152K for a short term (the legislated rate is currently 5.8%).So, the Funding Position for the purchase was as follows:

The interior fit out was all paid for by the tenant (his practice), so he got to claim the expenses as deductions.The rent that the practice pays their Self-Managed Super Fund every year is of course fully tax deductible. However, their Self-Managed Super Fund (SMSF) only pays 15% tax on it, rather than 45% if they had bought in their personal names.How much that effectively saves them is quite a big number…ready for it?Rent of $90,000 x (45% – 15%) = $27,000 annual cash saving.Once Jack retires (the loan will be repaid over 15 years) the tax rate changes to 0%, so they’ll have an annual pension of $90K pa in today’s dollar terms.But, let’s look at the 3 distinct negatives of his decision to buy it in Super:

- The equity they build up in the property will be unusable. Loans in Super can only be to acquire property, so they can’t increase the loan or leverage against it

- This building actually has the scope for another level to be built on top of it, but this is not allowed when the property is geared (property development is considered speculative)So, if today they wanted to build another level, they’d not only need to get $850K into Super to pay off the loan, but also the cash to build it.

- The paperwork is cumbersome and associated costs can amount to a few thousand dollars upfront and the ongoing costs for annual tax return & audits. Having said that, the above demonstrates that the benefits of the strategy far outweigh the costs.

WE'RE SUPPORTED BY THE MAJOR LENDERS