Dr. Sophia called me 4 years ago to see if I could arrange them a better interest rate, which is often where things start. She and her husband had an expensive $800,000 business loan at the Commonwealth Bank owing on the commercial building that her medical practice occupies. We refinanced the loan to Citibank, and used their home as collateral.

Amazingly, Citi offers owner-occupied interest rates when people use their home as collateral, even for investment, business, and commercial loans! Getting a 30-year loan term for tax-deductible debt is generally sought by most, which is why serious investors refinance every couple of years, re-setting a brand new 30-year loan term every time.

Did I mention Citibank rebate $4,000 to new customers? With their policies, I really don’t think they need to, but hey I’m not their CEO, so good luck to you borrowers.

Anyway, some years have passed. Like my clients are asked to do so, Dr. Sophia just called me to have a look at their current situation, just to see what’s out there and if there was anything better. I was initially stumped, as there’s not many banks that will refinance a commercial loan at an owner-occupied interest rate.

But I sat down and it took me about 30 seconds for the obvious to smack me in the face. I just got off the phone with Sophia and have made her day. This is why:

The commercial property is owned in their GST-registered partnership. which they originally did to get the GST back on rates and repairs. It’s worth $1.3M, with an $800,000 loan relating to it, still secured by their home at Citibank.

My accountant is calling her tomorrow to get the ball rolling for them to establish a Self-managed Superfund (SMSF) to acquire this property off them so it can be held in the best asset-protection vehicle in Australia, touchable only by death or divorce.

Rather than paying Marginal Tax Rates on the rent received as they do now, the rent paid by the business will now be taxed at 15% inside Super, and then at 0% once they hang their boots up.

The stamp duty for the purchase is $800 flat (awesome rules here in NSW) and whilst a Capital Gains Tax event takes place, the 50% discount CGT applies, and then Small Business Tax Concessions kick in to remove the need to pay any tax at all. This is because Sophia and her husband haven’t touched their $500,000 SBTC lifetime cap, particularly because they didn’t know they had one.

The Purchase Price of $1.3M will be funded by the loan taken by the SMSF of $800,000 and the $500,000 gap is closed with a simple paper entry, in-species non-concessional contributions of $250,000 each using the 3-year bring-forward rule.

There aren’t really any super-cheap loans for SMSF’s these days. Tina and I purchased the iChoice premises here in Strathfield in our SMSF 4 years ago and were lucky to get a cheap loan from Bankwest which is still cheap, at 2.9%. But the big banks exited this space in recent years and the lenders that will still lend to SMSF’s are a bit more expensive. Not that it worries Dr Sophia and her husband, as we’re arranging for them to be their own bank.

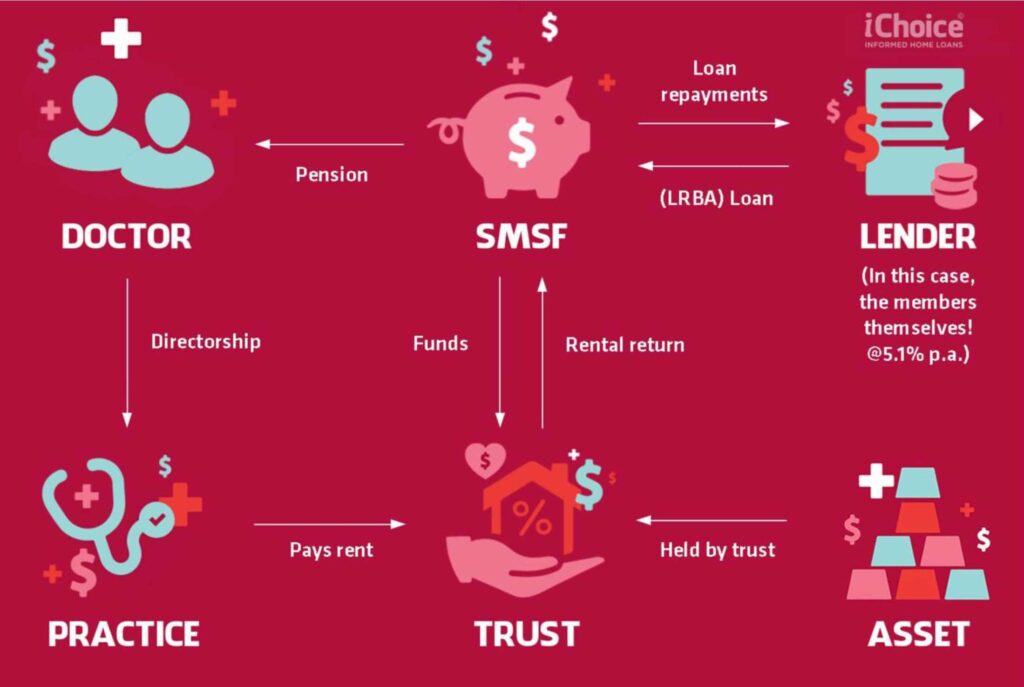

Yep, they’re using their Citibank loan (which is still secured by their home with a current interest rate of 2.39%) to provide a loan to their SMSF at 5.1% (the rate stipulated by the ATO). A very fancy simultaneous settlement indeed! They need to take a charge over the custodian trust that’s being set up to hold the property – the loan documentation between themselves and their SMSF needs to be spot on.

The Government won’t allow a bank or lender to take a mortgage over all the assets held in someone’s Super, so the property must be held in a Custodian Trust, sometimes called a Bare trust, because there’s nothing else owned inside it other than the property.

It sounds complicated but it isn’t. It just needs to be this way so the bank’s recourse is limited to the property itself. Maybe this diagram helps (thanks to my 14-year-old Simon who just created it!). Anyway, just consider it a heap of boring paperwork that needs a hundred signatures, but is worth the trouble.

For those who say ‘I can’t afford to buy a place in Super’, please add the word ‘yet’ after that. When my kids used to say ‘I can’t play the guitar, I had them say ‘yet’ after it. Same for people who say they ‘can’t afford a house in Sydney’. Please be aware that the language you use can actually affect how the inside of your brain processes stuff.

Dr. Sophia has now learned that the $65,000 annual rent paid by her practice will now be taxed at 15% rather than 47% – saving them $20,800 cash every year. When they retire and the tax rate becomes 0%, the saving will be ridiculous. The loan will be repaid by then, and they’ll enjoy an ongoing annual tax-free pension of $65,000 (in today’s dollars terms).

Kind of like a grown-ups’ everlasting gobstopper.

I forgot to mention to Sophia that their annual Land Tax bill will reduce by $12,000. I might not tell her, and leave it as a surprise. I don’t want her to get too excited, too soon.

But I think the real winners are Sophia’s young adult kids who have also contacted me. The younger people are when they start to be advised by specialists, the better. I know I wish I was my own mortgage broker when I was 22! Although I’m not sure brokers existed in 1992.

90% of my clients could walk into a bank and have money thrown at them, but they understand that there’s more to it and that they don’t know what they don’t know. You see, specialists appreciate specialists. I don’t play a musical instrument or know how to change a tyre, I just know my game. So I should, I’ve held management roles in 4 banks and now manage one of the best brokerages in the country.

There’s only 7 of us here at iChoice, but we’ve settled over a billion dollars in lending, most of which has been from simply refinancing people’s loans into cheaper and smarter lending structures.

I don’t make phone calls, I receive them, meaning that I only end up only helping people who want to help themselves. Good. I’m here for you guys whether you’re a medical professional or not. You might get 1 or two $3,000 refinance rebates, cheaper rates, and a structure that will make you better off. I’ll probably advise your home loan be split into three, with the fixed portion having an interest rate that starts with a 1.

But it’s horses for courses. And no matter what suits you, it’s often the structure, not just the rate, that makes all the difference. My services are free of charge and for the next few weeks I’m locked down at home, with more time on my hands than I normally do. Don’t be afraid to call me on a Saturday either – all the days feel pretty much the same at the moment, don’t they?

If you’d like to know what’s possible, I’m on 0400 900 300 or shoot me a note at [email protected]. Don’t be one of the people that back in the day Henry Ford referred to as wanting faster horses.