Industry Discounts

for Healthier Rewards

WE'RE SUPPORTED BY THE MAJOR LENDERS

Business Loans Sydney – Business Loan Broker

FIND THE COMMERCIAL LOAN THAT'S RIGHT FOR YOU

Medical Professional Loans – Doctor Loans – Dentist Loans

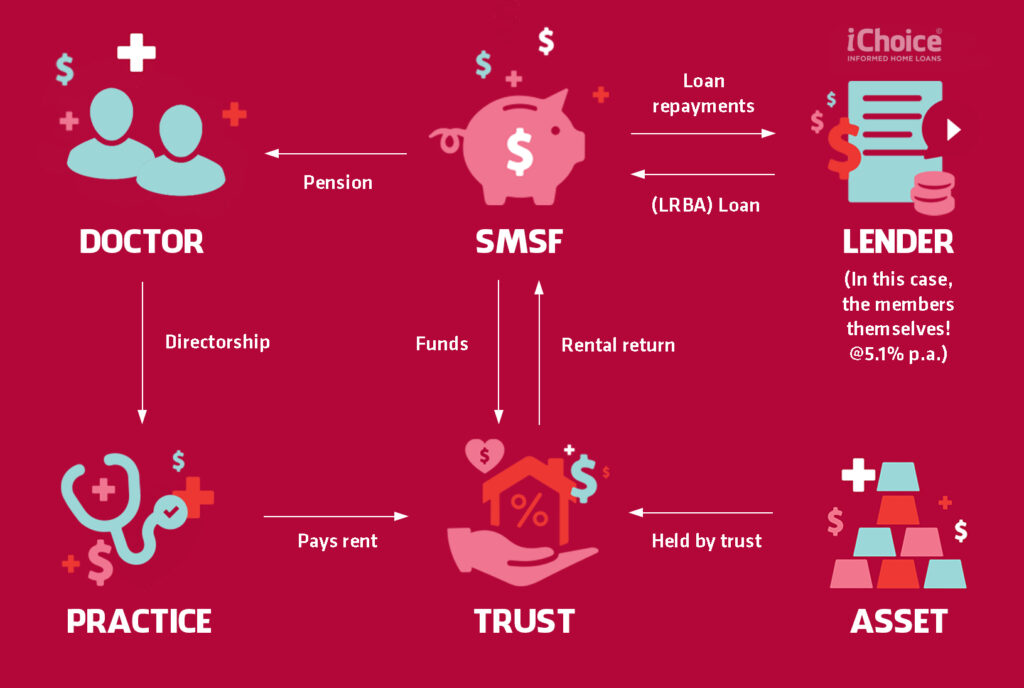

iChoice has come to specialise in assisting medical professionals all over Australia.Banks often apply unique credit policies for health professionals, the most well-known being their willingness to waive LMI and lend 90% of the property’s value up to a loan amount of $5M against one property ($7.5M aggregate). Note some banks have a smaller $2M maximums.This is because of your status and recognised profession. At the end of the day, you’re provide the bank with a low- risk opportunity, so they’ll accept a lower deposit. If you’re a surgeon, doctor, dentist, psychiatrist, you’ll qualify, but not all banks have the same list of approved medical occupations.For example, pharmacists and chiropractors qualify at only some banks.Our attention to tax minimisation and asset protection assists our clients build wealth safely and effectively. Whether you’re purchasing a surgery in your SMSF or just wanting to better structure your home loans, we’ll happily guide you, as the banks treatment of medical professionals vastly differs. We recommend you download our eBook, which addresses a few examples.

Special offerings are made available to police officers, ambulance drivers, SES employees and firefighters. Some lenders also understand your industry and will do things like take 100% of your overtime into consideration when assessing your capacity to service debt, unlike most banks.

Historically, sports professionals or professional athletes have had difficulties obtaining a home loan due to the nature of the industry they operate within. However, in recent years certain policies have been developed to make it easier for them to get a loan. Today, there are no limitations on which sport an athlete plays, for as long as they have an accredited manager, agent, or accountant. Even retired athletes may still be qualified for a home loan for sports professionals if they move into a related career such as coaching or sportscasting. What’s often required is the athlete’s valid and ongoing contract, evidence of income amounting to the minimum requirement, and tax returns for the past two years.

If you are a sports professional, you could be allowed to borrow up to 90% of the property value and avoid Lender’s Mortgage Insurance. Some lenders could also lend you up to 95% of the property value with a discount for the LMI cost. On top of that, you could get lower interest rates and longer interest terms (up to 15 years).

Here at iChoice, we know the right lenders who will give you the best home loan for sports professionals that have not been publicly advertised. We can help you improve your application to make it more agreeable to specific lenders, so you can get the deals that you want. Moreover, we will be with you every step of the way, so you won’t have to worry about missing a step in the home loan process.

CEOs and Business Owners typically have fluctuating incomes and no payslips, which can be challenging for them to qualify for a home loan. However, owning your business also means that you get the most of your profits. Luckily, not all lenders require strict documentation requirements like profit and loss statements. Basically, CEO/Business Owners will only need to present their individual and business tax returns with accompanying notices of assessment (NOA) for the past 2 years and their Australian Business Number (ABN) showing their last two years trading activity.

If you are a CEO or Business Owner looking for a home loan, you’ll be prompted to show paperwork that reflects your income, asset position, and credit history. Upon meeting these requirements, you can be qualified to borrow up to 95% of the property value. You may even still get approved for a loan amounting to 60% to 80% of the property value on a low doc loan. More than that, you may also be offered lower interest rates and discounted fees.

Lending policies are not always consistent, especially those designed for CEOs/Business Owners. However, our mortgage brokers at iChoice are always on top of these changes to know which lenders will be most helpful for you. Come to us with your tax returns and ABN so we can help you build a stronger home loan application that will elevate your chances of getting approved. We will carefully look over all your documents to make sure everything is in order before we lodge them with the lender. We can take the reins on processing your application, so you can focus on running your business while reaching your property ownership goals.

Accountants handle financial documents and calculate payments. Because of this, banks and lenders have the initial impression that they are good with money. They’re also perceived to have a high income earning potential. So, it’s not surprising that lenders tag accountants as trustworthy and low-risk borrowers. As such, they often get offered special discounts and lower interest rates. However, it will all still depend on the individual’s qualifications and actual income.

If you are an accountant applying for a home loan, you will need an industry membership and the required minimum annual income. This will get waived Lenders Mortgage Insurance, even if you are borrowing 90% of the property’s value. You might also be qualified to borrow 100% to 105% of the property’s value if you are borrowing with a guarantor. And, even if you are not offered a waived LMI or simply don’t need one, you will still be able to enjoy lower interest rates and discounts to lender’s fees.

Get your identification and financial records ready and consult our mortgage experts at iChoice. We can help you learn about the home loan options available for accountants. And, we’ll be more than happy to help you navigate your way into securing the right home loan to ease your needs.

Banks and lenders see lawyers, barristers, and solicitors differently than average borrowers. Legal professionals are thought to have a low-risk profile because of their higher level of job security and steady pay increase. With a practising certificate and a membership with one of Australia’s key industry associations, they are likely to qualify for exemptions.

If you are a lawyer applying for a home loan, you can borrow up to 90% of the property’s value without having to pay Lenders Mortgage Insurance (LMI). This can mean tens of thousands of dollars you get to keep in your pocket. However, financial institutions rarely advertise their lawyer-specific credit policies. So, it can be tricky to navigate access to them by directly visiting a bank. To ensure the best possible outcome for your unique situation, you need a knowledgeable broker that can act as your advocate in finding the best loan suited for your profession.

At iChoice, we will organise your loan application from sourcing to settlement. We are experts in unlocking exclusive benefits that are tailored for legal professionals. We can help you save valuable time and money, as well as help make the entire home loan process as smooth as possible. Speak to us today to learn all about how you can leverage your legal profession.

Self Employed Loans – Mortgage Broker for Self Employed

Getting finance when you’re self-employed can be a little tricky but there are still many options. With business banking backgrounds, we understand you need to get your lending thoughtfully structured. Please refer to the “Commercial” tab.If you’re self-employed and able to provide tax returns which demonstrate your capacity to service a loan, the process is simpler, but the banks all see you differently nevertheless. In particular, how they assess your capacity to service your loans vary a lot. For example, when determining your capacity to service a loan, most banks will want two-years of tax returns and financial information and average the profit (when determining your capacity to service a loan). Other banks ask for just the most recent years’ information.Some banks will add back all depreciation as a non-cash item and some will not. If you operate through a company, only some banks will take into account any undistributed profit. If you have existing business banking facilities, you’d probably want your home loans at a separate bank too, for asset protection.

Can I borrow against my property for business purposes?

A few banks will allow you to use your residential property to secure a ‘home loan’ product that is to be used for commercial use (for example to refinance a commercial bill and an overdraft). Normal discounted home loan rates and terms will apply!Most banks don’t though, insisting that due to the purpose, it should be a Business Loan product (more expensive and harsher terms). So get the right advice. There are thousands of people out there with business loans who just aren’t aware how cheap their loan could be if they were with the right bank.

What is a Low Doc?

Some banks offer Low-Doc loans which means that you’re not required to provide the usual verification of income if it’s not up to date. You must be self-employed, and may need to show some BAS statements to confirm the turnover of your business. If you’re only looking to borrow up to 60% of the value of a property, the rates for low doc loans can be the same as for full docs! Some lenders however, have higher rates for Low Docs.Some of the banks charge a higher interest rate for low-doc loans. You also may be required to pay Lenders Mortgage Insurance if you’re borrowing more than 60% of the value of a property. But the good news is that some banks do not differentiate so you can often land exceptional rates, just by providing BAS statements.There are a range of products that vary a lot in what they need from you to get it approved.